The materials sector may carry a reputation for conservatism, but its transformation is unmistakably underway. A key driver of this shift is materials informatics (MI): the application of data-centric approaches, including machine learning, advanced analytics, and digital infrastructures, to the discovery, development, and optimization of materials. Now a vital enabler in the innovation process, MI is redefining how R&D is done across industries from chemicals and energy to electronics and healthcare.

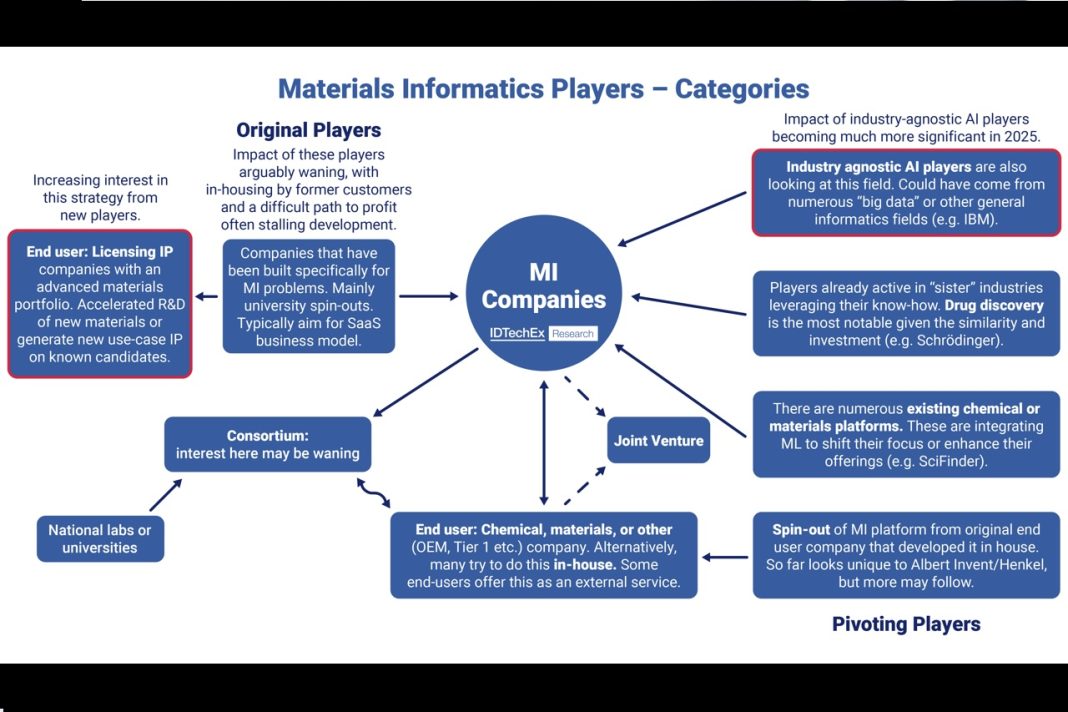

In the market report, “Materials Informatics 2025–2035: Markets, Strategies, Players,” IDTechEx charts the evolving MI ecosystem, examining the technologies, players, and strategies driving growth. Drawing on nearly 30 interviews with leading companies in the space, the report explores a critical question facing every organization looking to adopt materials informatics: Should you buy, build, or bridge the gap between expertise through external platforms?

The Promise, and Puzzle, of SaaS in Materials Informatics

Software-as-a-service (SaaS) platforms have played a pivotal role in democratizing access to materials informatics. These platforms offer comprehensive toolkits that combine data gathering, preprocessing, machine learning, and visualization, often in a user-friendly interface that requires little to no coding. For materials scientists without extensive data science backgrounds, these platforms provide a powerful on-ramp to AI-driven research.

This appeal is reflected in strong market momentum. IDTechEx forecasts that external MI services, many of which are delivered via SaaS, will grow at a robust 9.0% CAGR through 2035. Major providers like Citrine Informatics, Uncountable, and MaterialsZone are expanding both capabilities and client lists, while new entrants continue to innovate on user experience, interoperability, and model transparency.

But while SaaS can accelerate deployment and reduce barriers to entry, it’s not a one-size-fits-all solution. During interviews, IDTechEx heard from multiple industry leaders who questioned the long-term strategic fit of off-the-shelf MI platforms. For materials giants with deep R&D budgets and complex needs, the case for building internal capabilities, custom tools, domain-specific models, and proprietary infrastructures, can be more compelling.

Why Some Firms Choose to Build

Take 3M, which has publicly highlighted its efforts to revamp internal data architectures and leverage MI for adhesive formulation. For companies like this, control over workflows, intellectual property, and model customization is paramount. Similarly, firms like Hitachi have gone one step further, developing their own MI platforms in-house and then commercializing them as SaaS offerings for other organizations.

This divergence in strategy highlights a growing tension in the field: ease of access versus strategic differentiation. While SaaS platforms provide accessibility and speed, they may not support the level of customization or data integration required by large, diversified R&D organizations. Moreover, reliance on third-party vendors raises concerns about long-term platform stability and data sovereignty.

The fear is not unfounded. Should a SaaS provider go out of business or pivot away from the materials sector, companies that have built their workflows around that tool could be left stranded. Despite robust efforts by MI providers to emphasize data security and reliability, skepticism remains, particularly when proprietary experimental data has become one of a firm’s most valuable assets.

Bridging the Expertise Gap

For organizations not ready to fully build in-house or entirely buy-in, there’s a third path: bridging the gap with hybrid approaches. Some firms are turning to specialist consultants like Enthought to develop customized MI solutions atop existing digital infrastructure. Others are using SaaS platforms as a foundation, supplementing them with internal scripts, third-party APIs, or customized models.

This modular strategy allows companies to ramp up their MI capabilities while retaining flexibility for future evolution. It also acknowledges a core challenge in the field: few individuals possess deep expertise in both materials science and data science. Effective MI implementations require bridging that gap, whether through platform design, training programs, or cross-functional teams.

A Strategic Inflection Point for Materials R&D

The decision between buying, building, or bridging an MI solution is not just technical; it’s strategic. It reflects a company’s broader goals in digital transformation, innovation velocity, and competitive positioning.

What’s clear is that the field is maturing. Since 2020, when IDTechEx first began covering materials informatics, the sector has evolved from a niche discipline to a core enabler of smart materials R&D. The 2025 edition of the report arrives at a moment of strategic reflection for many firms: How can they best leverage materials informatics to accelerate discovery, protect data, and extract long-term value?

“Materials Informatics 2025–2035: Markets, Strategies, Players” delivers a detailed roadmap for navigating this transformation. The report covers:

- Comparative analysis of MI implementation strategies

- Profiles of 30+ key players across software and materials

- Technology roadmaps, algorithmic approaches, and application case studies

- Market forecasts to 2035, investment trends, and emerging business models

Whether you’re an innovator in materials development, a technology strategist, or an investor in the next wave of digital R&D, this report offers the insights needed to make informed decisions in a rapidly evolving space.

To learn more or purchase the report, visit www.IDTechEx.com/MaterialInformatics, or contact research@idtechex.com.